bio

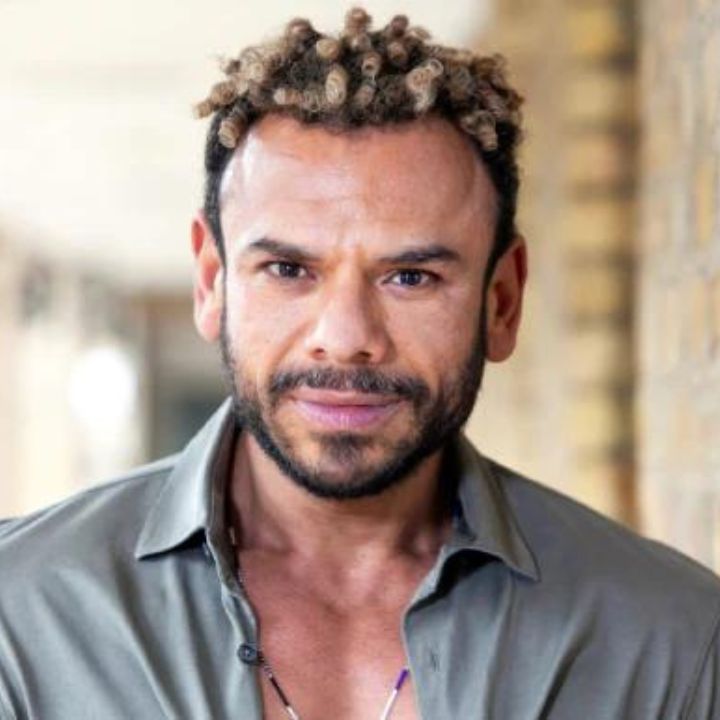

Professor Tahoun is a Professor at London Business School. Tahoun was named as one of the Top 40 Professors under 40. He has been a research scholar at the University of Chicago Booth School of Business and the Wharton School, a faculty member at the London School of Economics, a research fellow at the University of Valencia, and a banker at HSBC.

The current focus of Tahoun’s research is on “Text as Data.” In particular, he develops methodologies to convert raw text into actionable data. These methods can predict the impact of systemic shocks, whether political events or global pandemics, and create firm-level metrics for various issues like cyber-security risk, inflation, and climate change. He adapts techniques from computational linguistics to construct data sets valuable for policymakers. These can be used to monitor country risk and sentiment, analyse risk transmission during crises, measure the risks, costs, and opportunities firms associate with specific shocks and policies, and compare impacts attributed to different sources.

Tahoun’s research also tackles important questions in society, ranging from the quid-pro-quo relations between politicians and the corporate world, the economic consequences of revolutions, and the global development of securities law in response to corporate scandals during the past 200 years. He has also been engaged in comparative international work on executive compensation, looking for the roots of cross-country differences in pay packages. Furthermore, Tahoun researches and publishes work on the economic outcomes of transparency. These studies aim to understand the impact of information provision and dissemination and question if more information always leads to better outcomes.

Tahoun has published his research in the Quarterly Journal of Economics, the Review of Economic Studies, the Journal of Finance, the Review of Financial Studies, the Journal of Financial Economics, the Journal of Accounting Research, the Journal of Accounting and Economics, the Accounting Review and the Review of Finance.

The Economist, the New York Times, the Wall Street Journal and the Financial Times have covered his work. In the classroom, Tahoun teaches the MBA programme, and he delivers a course on managerial accounting tools and another course on organisational designs. Tahoun is currently an associate editor at the Journal of Accounting Research. He has been the recipient of ten consecutive grants from the prestigious Institute of New Economic Thinking; he has twice received LBS’s faculty research award; he was granted the Referee of the Year award by the Journal of Accounting Research and was made a member of its editorial board.

Tahoun did his doctoral training at six institutions in five countries: the Wharton School and Chicago Booth in the US, the London School of Economics and the University of Manchester in the UK, Tilburg University in the Netherlands, the University of Valencia in Spain, and Cairo University in Egypt.

Tahoun is a member of the Wheeler Institute Call for Proposals Faculty Committee.

Publications

The Diffusion of Disruptive Technologies

Abstract

We identify novel technologies using textual analysis of patents, job postings, and earnings calls. Our approach enables us to identify and document the diffusion of 29 disruptive technologies across firms and labor markets in the U.S. Five stylized facts emerge from our data. First, the locations where technologies are developed that later disrupt businesses are geographically highly concentrated, even more so than overall patenting. Second, as the technologies mature and the number of new jobs related to them grows, they gradually spread geographically. While initial hiring is concentrated in high-skilled jobs, over time the mean skill level in new positions associated with the technologies declines, broadening the types of jobs that adopt a given technology. At the same time, the geographic diffusion of low-skilled positions is significantly faster than higher-skilled ones, so that the locations where initial discoveries were made retain their leading positions among high-paying positions for decades. Finally, these pioneer locations are more likely to arise in areas with universities and high skilled labor pools.

The Anatomy of Cyber Risk

Abstract

We construct novel text-based measures of firm-level cyber risk exposure based on quarterly earnings calls of 12,000+ firms from 85 countries over 20+ years. We categorize each cyber-related discussion into topics that capture sentiment, monetary loss, country names, etc. We document new facts on the worldwide rise of cyber risk and its industrial and geographical composition. We characterize most affected firms and show that our indices can predict future cyberattacks. Cyber risk exposure has significant direct and contagion effects on stock returns. Finally, there is a factor structure in our firm-level measures and shocks to the common factor are priced.